This has zero percent attract funds more ten years

The brand new System Town is generally undergoing a genuine house boom downtown, however, tens and thousands of distressed features regarding city nevertheless need assistance. CNBC’s Realty Consider column takes a glance at work from the nonprofits also LISC so you can smooth out this new appraisal gap which makes it so difficult to own low-income customers to solve upwards their houses. Detroit LISC’s Tahirih Ziegler weighs in at when you look at the about how no per cent financing are part of the solution.

. One of the largest traps in order to homeowners in Detroit is exactly what area authorities label the new assessment pit. The fresh city’s median domestic pricing is merely $24,000, according to RealComp, because unnecessary property try foreclosure or have been bought because of the traders using cash. Traders renovate the brand new home, driving in the viewpoints, however the new, reduced marketing prices are nonetheless put since the comparables for nearby appraisals. Normal, mortgage-founded customers who would like to rehab homes and you will reside in them, can not score large enough mortgage loans since the house they are interested are appraising too low. Detroit Mortgage loan can offer an option.

Courtesy a combination of social and personal financing, cut off features, and you will $5 million away from Lender out of The usa, the application form was helping latest property owners so you’re able to rehabilitation their attributes, again, including really worth and commitment to local neighborhoods

“We are in this cyclical clutter, therefore we want Wyoming personal loans to avoid one to cycle and offer the fresh money in order to consumers,” said Pate.

Because of a mix of individual funding and venture of 5 some other banking institutions, the program now offers step 3.5 % downpayment, fixed-price fund so you can buyers that have about a great 640 FICO get. They broke up the borrowed funds in two, into the earliest since the appraised worth of your house and the following loan covering the “appraisal gap,” that will be the worth of the house once renovated and you will on the open market. Next financing was held because of the a nonprofit.

“We realize you are getting people for the an underwater financial built into the simple appraisals, therefore we separated it therefore we you will definitely would guarantee defense. I broke up brand new mortgage loans right up in line with the really worth. When there is a trouble, or lifestyle experiences, up coming what will happen is they would complete documents into the nonprofit and in addition we manage forgive the amount of the following home loan along side appraised worthy of,” Pate said.

However, rehabbing the outdated bones from old Detroit property is element of each other area stabilizing and you may revitalization. That is the first step toward a new system work with of the a separate Michigan indigenous. Detroit LISC (Regional Attempts Help Business) falls under federal LISC, a residential district-oriented creativity providers that works well to alter troubled communities.

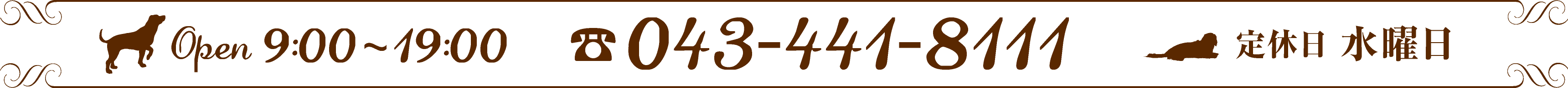

“We have been taking care of a partnership to the Town of Detroit Home Fix System to bring money returning to communities for property owners have been in their house at the very least half a year,” told you Tahirih Ziegler, exec movie director regarding LISC Detroit.

“The mark is actually into the present homeowners that root in town to change its qualities. Once they lack the means to access resource, it be part of the material regarding blight and you may community disinvestment. It’s getting people to provides an individual partnership,” told you Ziegler.

Lillie Gibson, 76, a good lifelong resident out-of Detroit exactly who retired out-of your state business possess stayed in their own domestic for over 47 decades. The fresh zero per cent financial to own $18,608 have invited Gibson to get the new plastic siding and you will a this new roof complete with upgraded rooftop chatrooms, shingles, aluminum gutters and downspouts.

Gibson’s priority would be to address the latest deteriorated roof that brought about h2o in order to load on the structure while in the huge rainfall. For over five years, she made use of buckets to catch the water through the leaky roof. She found brand new no percent house repair mortgage system by way of a narrative regarding the local news media. Through the system, she has also been in a position to secure home insurance one to she got already been refuted getting before due to their unique money and you may the spot of the property. Gibson try very pleased for the quality of the work: “One-night I woke up and it’s raining. I started to awaken to find the buckets but We checked up-and told you, “Many thanks Jesus. The task is over.”